UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material Pursuant to Section 240.14a-12 |

EVI Industries, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. |

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

EVI Industries, Inc.

4500 Biscayne Blvd., Suite 340

Miami, Florida 33137

November 27, 2019

Dear Stockholder:

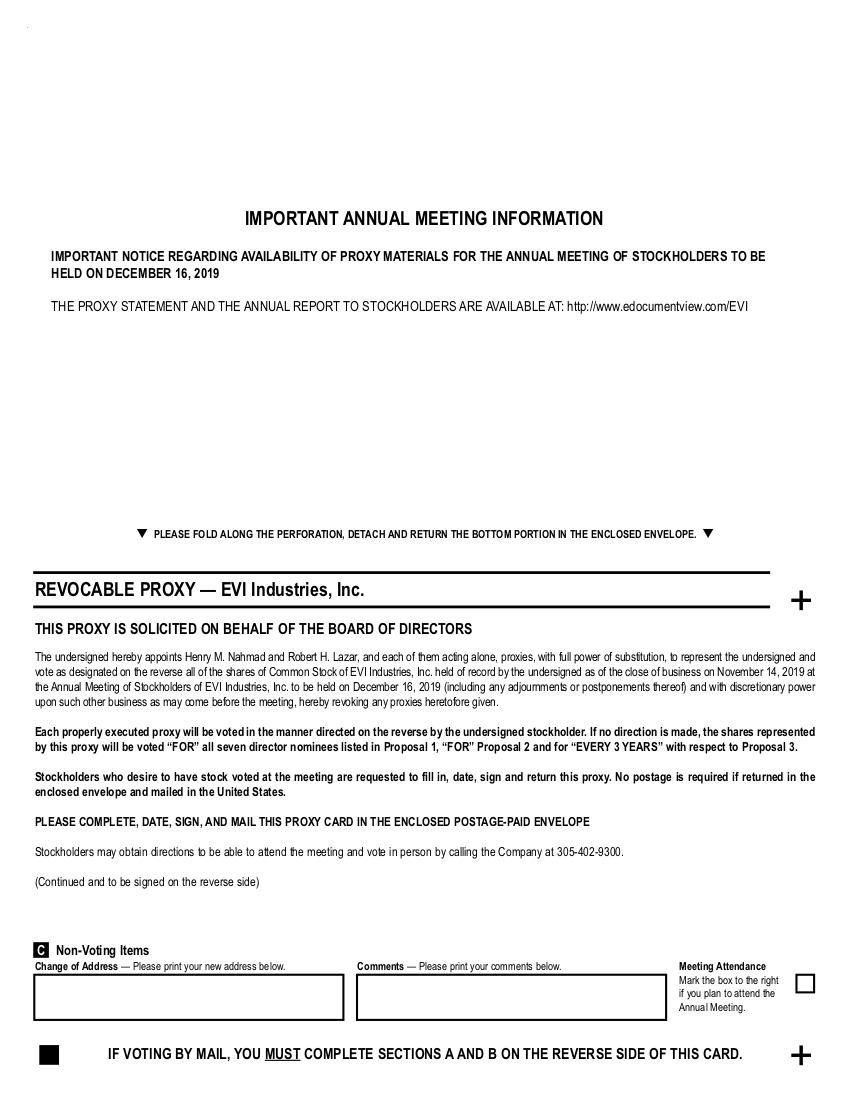

You are cordially invited to attend the 2019 Annual Meeting of Stockholders of EVI Industries, Inc., which will be held on December 16, 2019 at 11:00 a.m., local time, at Apollo Bank, 1150 South Miami Avenue, Miami, Florida 33130.

Please read these materials so that you will know what we plan to do at the Annual Meeting. Also, please sign and return the accompanying proxy card in the postage-paid envelope. This way, your shares will be voted as you direct even if you cannot attend the Annual Meeting.

On behalf of your Board of Directors and our employees, I would like to express our appreciation for your continued support.

| Sincerely, | |

| |

| Henry M. Nahmad | |

| Chairman of the Board |

EVI Industries, Inc.

4500 Biscayne Blvd., Suite 340

Miami, Florida 33137

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held on December 16, 2019

Notice is hereby given that the Annual Meeting of Stockholders of EVI Industries, Inc. (the “Company”) will be held at Apollo Bank, 1150 South Miami Avenue, Miami, Florida 33130, on December 16, 2019, commencing at 11:00 a.m., local time, for the following purposes:

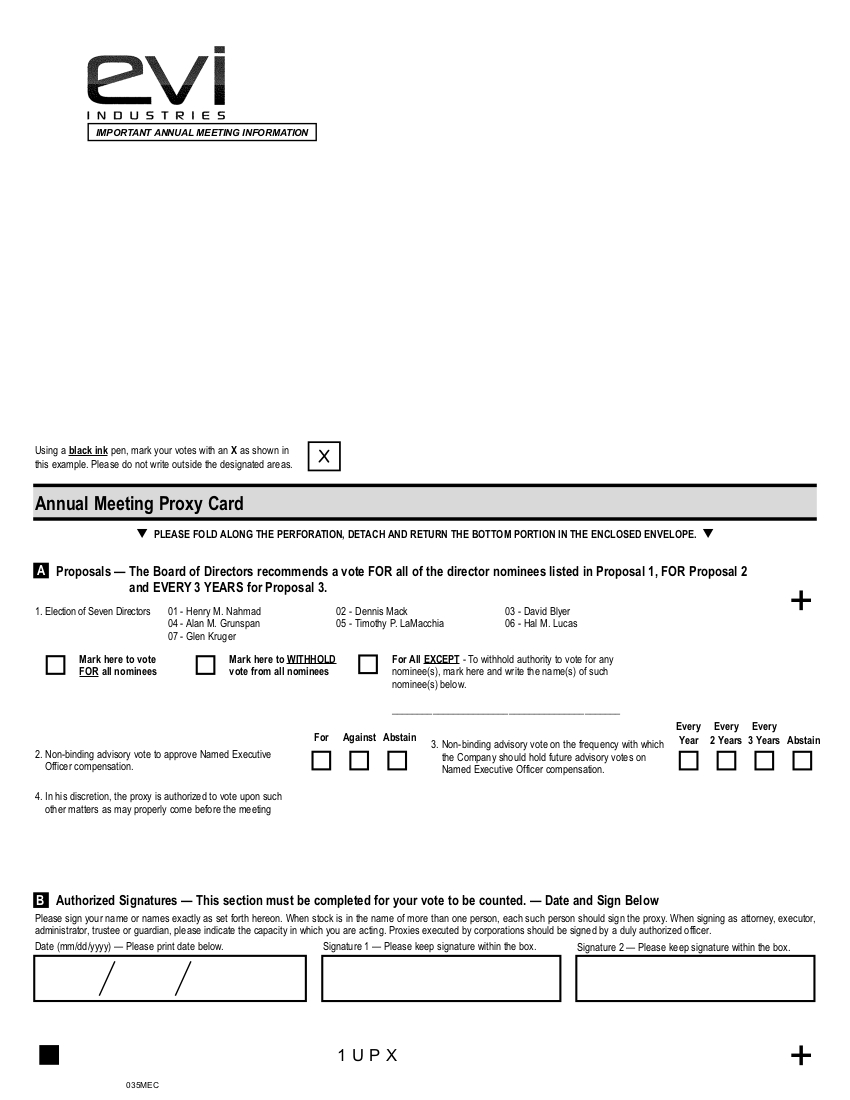

1. To elect seven directors to the Company’s Board of Directors to serve until the Company’s 2020 Annual Meeting of Stockholders.

2. To vote, on a non-binding advisory basis, on the compensation of the Company’s Named Executive Officers, as disclosed in the section of the accompanying Proxy Statement entitled “Named Executive Officer Compensation.”

3. To vote, on a non-binding advisory basis, on the frequency with which the Company should hold future advisory votes on Named Executive Officer compensation.

4. To transact such other business as may properly be brought before the Annual Meeting or any adjournment or postponement thereof.

The matters listed above are more fully described in the Proxy Statement that forms a part of this Notice of Meeting.

Only record holders of the Company’s Common Stock as of the close of business on November 14, 2019 are entitled to notice of, and to vote at, the Annual Meeting.

| Sincerely yours, | |

| |

| Henry M. Nahmad | |

| Chairman of the Board |

Miami, Florida

November 27, 2019

IMPORTANT: THE PROMPT RETURN OF PROXIES WILL SAVE THE COMPANY THE EXPENSE OF FURTHER REQUESTS FOR PROXIES. THEREFORE, EVEN IF YOU PLAN TO ATTEND THE ANNUAL MEETING, PLEASE COMPLETE, SIGN AND RETURN THE ENCLOSED PROXY CARD IN THE ENVELOPE PROVIDED. NO POSTAGE IS REQUIRED FOR THE PROXY CARD IF MAILED IN THE UNITED STATES.

EVI Industries, Inc.

4500 Biscayne Blvd., Suite 340

Miami, Florida 33137

PROXY STATEMENT

The Board of Directors of EVI Industries, Inc. (the “Company”) is soliciting proxies to be used at the 2019 Annual Meeting of Stockholders of the Company (the “Annual Meeting”) to be held at Apollo Bank, 1150 South Miami Avenue, Miami, Florida 33130, on December 16, 2019, commencing at 11:00 a.m., local time, and at any and all postponements or adjournments of the Annual Meeting, for the purposes set forth in the accompanying Notice of Meeting.

This Proxy Statement and the accompanying Notice of Meeting and proxy card are first being mailed to stockholders on or about November 27, 2019.

QUESTIONS AND ANSWERS

ABOUT THE PROXY MATERIALS

AND THE ANNUAL MEETING

What is the purpose of the Annual Meeting?

At the Annual Meeting, stockholders will be asked to consider and vote upon the election of seven directors to the Company’s Board of Directors, each for a term expiring at the Company’s 2020 Annual Meeting of Stockholders. Stockholders will also be asked to vote, on a non-binding advisory basis, on the compensation of the Company’s Named Executive Officers (as hereinafter defined) and, as required every six years, on the frequency with which the Company should hold future advisory votes on Named Executive Officer compensation. In addition, although the Board of Directors is not aware of any other matters to be presented at the Annual Meeting, if any other matters are properly brought before the Annual Meeting, stockholders will be asked to consider and vote upon such matters.

Who is entitled to vote at the meeting?

Record holders of the Company’s Common Stock as of the close of business on November 14, 2019 (the “Record Date”) may vote at the Annual Meeting. As of the close of business on the Record Date, 12,652,085 shares of the Company’s Common Stock were outstanding and, thus, will be eligible to vote at the Annual Meeting.

What are the voting rights of the holders of the Company’s Common Stock?

Holders of the Company’s Common Stock are entitled to one vote per share on each matter considered at the Annual Meeting.

What constitutes a quorum?

The presence, in person or by proxy, of at least a majority of the shares of the Company’s Common Stock issued and outstanding as of the close of business on the Record Date is necessary to transact business at the Annual Meeting. Abstentions and “broker non-votes” will be included in determining the presence of a quorum at the Annual Meeting. If there are not sufficient shares represented for a quorum, then the Annual Meeting may be adjourned or postponed from time to time until a quorum is established.

1

What is the difference between a stockholder of record and a “street name” holder?

If your shares are registered directly in your name with Computershare, the Company’s stock transfer agent, you are considered the stockholder of record with respect to those shares. If your shares are held in a stock brokerage account or by a bank or other nominee, you are considered the beneficial owner of the shares but not the stockholder of record, and your shares are held in “street name.”

How do I vote my shares?

If you are a stockholder of record, you can give a proxy to be voted at the Annual Meeting by mailing the enclosed proxy card. You may also vote your shares at the Annual Meeting by completing a ballot at the Annual Meeting.

If you hold your shares in “street name,” you must vote your shares in the manner prescribed by your broker, bank or other nominee. Your broker, bank or other nominee has enclosed or provided a voting card for you to use in providing your voting instructions.

Can I vote my shares in person at the Annual Meeting?

If you are a stockholder of record, you may vote your shares in person at the Annual Meeting by completing a ballot at the Annual Meeting. However, if you are a “street name” holder, you may vote your shares in person at the Annual Meeting only if you obtain a signed proxy from your broker, bank or other nominee giving you the right to vote the shares. Even if you currently plan to attend the Annual Meeting, the Company recommends that you also submit your vote by proxy or by providing your voting instructions to your broker, bank or other nominee as described above so that your vote will be counted if you later decide not to attend the Annual Meeting.

What are my choices when voting?

With respect to the election of directors, you may vote for all of the director nominees, or your vote may be withheld with respect to one or more of the director nominees. The proposal related to the election of directors is described in this Proxy Statement beginning on page 10.

In addition, you may vote for or against, or abstain from voting on, each of the compensation of the Company’s Named Executive Officers and the frequency with which the Company should hold future advisory votes on Named Executive Officer compensation. The proposal relating to the compensation of the Company’s Named Executive Officers is described in this Proxy Statement on page 20. The proposal relating to the frequency with which the Company should hold future advisory votes on Named Executive Officer compensation is described in this Proxy Statement on page 21.

What are the Board’s voting recommendations?

The Board of Directors recommends that you vote your shares FOR ALL of the director nominees, FOR the approval of the compensation of the Company’s Named Executive Officers, and for future advisory votes on Named Executive Officer compensation to be held EVERY THREE YEARS.

What if I do not specify on my proxy card how I want my shares voted?

If you execute and mail in your proxy card but do not specify on your proxy card how you want to vote your shares, your shares will be voted FOR ALL of the director nominees, FOR the approval of the compensation of the Company’s Named Executive Officers, and for future advisory votes on Named Executive Officer compensation to be held EVERY THREE YEARS. Although the Board of Directors is not aware of any other matters to be presented at the Annual Meeting, if any other matters are properly brought

2

before the Annual Meeting, the individuals named in the enclosed proxy card (or their substitutes if they are unavailable) will vote the proxies in accordance with their judgment on those matters.

Can I change my vote?

Yes. You can change your vote at any time before your proxy is voted at the Annual Meeting. If you are the record owner of your shares, you can do this in one of three ways. First, you can send a signed written notice to the Company’s President stating that you would like to revoke your proxy. Second, you can submit a new valid proxy bearing a later date. Third, you can attend the Annual Meeting and vote in person. However, attendance at the Annual Meeting will not, in and of itself, constitute revocation of a previously executed proxy.

If you are not the record owner of your shares and your shares are held in “street name,” you must contact your broker, bank or other nominee to find out how to change your vote.

What vote is required for a proposal to be approved?

The Company’s directors are elected by plurality vote, meaning that the seven director nominees receiving the greatest number of votes for election will be elected. A properly executed proxy marked to withhold a vote with respect to the election of one or more director nominees will not be voted with respect to the nominee or nominees indicated, although it will be counted for purposes of determining whether or not a quorum exists.

The compensation of the Company’s Named Executive Officers will be approved, on a non-binding advisory basis, if it receives the affirmative vote of a majority of the shares of the Company’s Common Stock present in person or represented by proxy at the Annual Meeting and entitled to vote on the proposal.

With respect to the non-binding advisory vote on the frequency with which the Company should hold future advisory votes on Named Executive Officer compensation, the frequency (every year, every other year, or every three years) which receives the greatest number of votes will be the frequency selected by the stockholders.

Abstentions will be counted for purposes of determining whether or not a quorum exists and will effectively count as votes against the proposal related to the compensation of the Company’s Named Executive Officers but not have any impact on the proposal related to the frequency with which the Company should hold future advisory votes on Named Executive Officer compensation. Provided a quorum exists, failures to vote will not have any impact any proposal.

The vote on the compensation of the Company’s Named Executive Officers and the vote on the frequency with which the Company should hold future advisory votes on Named Executive Officer compensation are advisory only, and neither will be binding upon the Company or its Board of Directors or Compensation Committee.

If my shares are held in street name, will my broker, bank or other nominee vote my shares for me?

No. If you hold your shares in “street name” through a broker, bank or other nominee, whether your broker, bank or other nominee may vote your shares in its discretion depends on the proposals before the Annual Meeting. The Company’s Common Stock is listed for trading on the NYSE American. Under the rules of the NYSE American, if you do not provide your broker, bank or other nominee with voting instructions with respect to your shares, your broker, bank or other nominee will not have discretion to vote your shares for you on any of the items to be considered at the Annual Meeting. Accordingly, it is important that “street name” holders give voting instructions to their broker, bank or other nominee by following the voting instructions received from their broker, bank or other nominee.

3

What are broker non-votes?

When a broker, bank or other nominee has discretion to vote on one or more proposals at a meeting but does not have discretion to vote on other matters at the meeting, the broker, bank or other nominee will inform the inspector of election that it does not have the authority to vote on certain matters with respect to shares held for beneficial owners who did not provide voting instructions on those matters. This is generally referred to as a “broker non-vote.” Because brokers, banks and other nominees will not have discretion to vote on any items of business at the Annual Meeting if they have not received voting instructions from their clients, there will not be “broker non-votes” on any matter presented at the Annual Meeting.

Are there any other matters to be acted upon at the Annual Meeting?

The Company does not know of any matters to be presented or acted upon at the Annual Meeting other than those described in this Proxy Statement. If any other matter is presented at the Annual Meeting on which a vote may properly be taken, the shares represented by proxies will be voted in accordance with the judgment of the person or persons voting those shares.

4

CORPORATE GOVERNANCE

Board of Directors

Pursuant to the Company’s By-laws and Delaware law, the Company’s business and affairs are managed under the direction of the Company’s Board of Directors. Directors are kept informed of the Company’s business through discussions with management, including the Company’s Chief Executive Officer and other officers, by reviewing materials provided to them and by participating in meetings of the Board of Directors and its committees.

Controlled Company

The Company’s Common Stock is listed on the NYSE American. Under the rules of the NYSE American, the Company is considered a “controlled company” because Henry M. Nahmad, directly and indirectly through Symmetric Capital LLC (“Symmetric Capital”) and Symmetric Capital II LLC (“Symmetric Capital II”) (each of which Mr. Nahmad may be deemed to control by virtue of his position as Manager of such entity), holds more than 50% of the voting power of the Company. Mr. Nahmad is the Company’s Chairman, Chief Executive Officer and President.

As a “controlled company,” the Company is exempt from certain rules and requirements of the NYSE American related to corporate governance matters, including the rules requiring that (i) the Company’s Board of Directors be comprised of at least a majority of independent directors, (ii) the compensation of the Company’s executive officers be determined, or recommended to the Board of Directors for determination, either by a compensation committee comprised of independent directors or by a majority of the independent directors, and (iii) nominations for election to the Company’s Board of Directors be either selected, or recommended for the Board of Directors’ selection, by either a nominating committee comprised solely of independent directors or by a majority of the independent directors. However, the Company’s Board of Directors is currently, and historically has generally been, comprised of a majority of independent directors, and the Company has a standing Compensation Committee comprised solely of independent directors which, among other things, determines the compensation of the Company’s Chief Executive Officer and determines, or recommends to the Board of Directors the determination of, the compensation of the Company’s other executive officers.

Director Independence

The Company’s Board of Directors determined that David Blyer, Alan Grunspan, Timothy P. LaMacchia, Hal M. Lucas and Todd Oretsky, who together comprise a majority of the Board of Directors, are independent. In addition, the Board of Directors has determined that Glen Kruger, who is nominated for election to the Board at the Annual Meeting, is independent. For purposes of making its independence determinations, the Board of Directors used the definition of independence set forth in the rules of the NYSE American.

Meetings of the Board

The Company’s Board met fourteen times during the fiscal year ended June 30, 2019 (“fiscal 2019”). Each member of the Board of Directors attended at least 75% of the meetings of the Board and committees on which he served during fiscal 2019.

It is the Company’s policy that, absent extenuating circumstances, all members of the Board of Directors attend meetings of stockholders. Six of the Company’s directors attended the Company’s 2018 Annual Meeting of Stockholders.

5

Committees of the Board of Directors

Audit Committee

The Company’s Board of Directors has a standing Audit Committee. The Audit Committee is currently comprised of Timothy P. LaMacchia, Chairman, Alan M. Grunspan and Todd Oretsky. The Board determined that each member of the Audit Committee is “financially literate” and “independent” within the meaning of rules of the NYSE American (including, with respect to their independence, the additional independence requirements applicable to audit committee members thereunder) and applicable Securities and Exchange Commission (“SEC”) rules and regulations. In addition, the Board determined that Mr. LaMacchia qualifies as an “audit committee financial expert,” as defined under Item 407 of Regulation S-K promulgated by the SEC. The Audit Committee held four formal meetings during fiscal 2019.

The Audit Committee operates under a written charter adopted by the Board, which the Audit Committee reviews and assesses at least annually. If the Audit Committee deems it to be appropriate, the Audit Committee may amend, or recommend to the full Board amendments to, the Audit Committee charter. The Audit Committee charter is posted in the “Investors – Corporate Governance – Governance Documents” section of the Company’s website at www.evi-ind.com.

Pursuant to its charter, the Audit Committee provides assistance to the Board in fulfilling the Board’s oversight responsibilities with respect to accounting, auditing, financial reporting practices and legal compliance. Under its charter, the Audit Committee reviews: the financial reports and other financial information provided by the Company to the SEC; the Company’s systems of internal control over financial reporting; and the Company’s auditing, accounting and financial reporting processes generally. The Audit Committee also is responsible for the appointment and retention of, and the Audit Committee reviews and appraises the performance, qualifications and independence of, the Company’s independent registered public accounting firm, and the Audit Committee approves the fees and other compensation paid to the Company’s independent registered public accounting firm. A report from the Audit Committee is included in this Proxy Statement on page 23.

The Company and Mr. Oretsky have mutually agreed that Mr. Oretsky will not be nominated or stand for re-election at the Annual Meeting and, accordingly, Mr. Oretsky’s service on the Board and the Audit Committee will cease upon the election of directors at the Annual Meeting. Subject to his election at the Annual Meeting, the Board has appointed Glen Kruger to the Audit Committee in place of Mr. Oretsky. The Board determined that Mr. Kruger is “financially literate” and “independent” within the meaning of rules of the NYSE American (including, with respect to his independence, the additional independence requirements applicable to audit committee members thereunder) and applicable SEC rules and regulations, and that he qualifies as an “audit committee financial expert,” as defined under Item 407 of Regulation S-K promulgated by the SEC.

Compensation Committee

The Company’s Board of Directors has a standing Compensation Committee. The Compensation Committee is comprised of Hal M. Lucas, Chairman, and David Blyer. The Company’s Board of Directors has determined that each member of the Compensation Committee is “independent,” within the meaning of the rules of the NYSE American (including the additional independence requirements applicable to compensation committee members thereunder). The Compensation Committee held two formal meetings during fiscal 2019.

The Compensation Committee operates under a written charter adopted by the Board, which the Compensation Committee reviews and assesses at least annually. If the Compensation Committee deems it to be appropriate, the Compensation Committee will recommend to the full Board changes to the Compensation Committee charter. The Compensation Committee charter is posted in the “Investors – Corporate Governance – Governance Documents” section of the Company’s website at www.evi-ind.com.

6

Among other responsibilities set forth in its charter, the Compensation Committee determines the compensation, including base salary and incentive compensation, of the Company’s Chief Executive Officer and, with the input and assistance of the Company’s Chief Executive Officer, determines, or recommends to the full Board, the compensation, including base salary and incentive compensation, of the Company’s other executive officers. The Company’s executive compensation program is designed to align the interests of the Company’s executive officers with those of stockholders, reward performance and long-term value creation, recognize the individual performance, skills and responsibilities of each executive officer, and attract, retain, motivate and reward executive officers who have the experience and ability to conceive and successfully execute the Company’s business strategies. The Compensation Committee reviews the Company’s executive compensation practices as considered to be necessary with a goal of assuring the fairness of the Company’s executive compensation and its support of the strategic goals of the Company. The Compensation Committee also recommends to the full Board, with the input and assistance of the Company’s Chief Executive Officer, the compensation of the Company’s directors and, subject to any permitted delegation, administers the Company’s equity-based compensation and employee stock purchase plans.

Pursuant to its charter, the Compensation Committee has the authority to retain consultants to assist the Compensation Committee in its evaluation of executive compensation, as well as the authority to approve any such consultant’s fees and retention terms. The Compensation Committee has engaged Pearl Meyer & Partners, LLC, a third party compensation consultant (“Pearl Meyer”), to assist the Compensation Committee with respect to certain executive compensation matters, including the compensation of the Company’s Chief Executive Officer.

No Standing Nominating Committee

As described above, as a “controlled company” under the rules of the NYSE American, nominees for director of the Company are not required to be selected or recommended to the Board by either a standing nominating committee comprised solely of independent directors or by a majority of the Company’s independent directors. The Company does not have a standing nominating committee nor are directors required to be selected or recommended by a majority of the Company’s independent directors. Instead, the full Board of Directors participates in the consideration of director nominees. The Board believes this structure to be appropriate because, as described above, Henry M. Nahmad, the Company’s Chairman, Chief Executive Officer and President, has, directly or indirectly, voting power over more than 50% of the Company’s outstanding Common Stock and, therefore, is in a position to control the election of the Company’s directors. The Board does not have a charter governing its nomination process.

While the Board will consider nominees recommended by stockholders, it has not actively solicited recommendations from stockholders. Although the Board has not established specific minimum qualifications, or specific qualities or skills for prospective nominees, the Board, in evaluating director nominees, generally considers, among other things, a potential nominee’s financial and business experience, educational background, understanding of the Company’s business and industry, skills that would complement rather than duplicate skills of existing Board members, demonstrated ability in his or her professional field, integrity and reputation, willingness to work productively with other members of the Board and represent the interests of stockholders as a whole, and time availability to perform the duties of a director. The Board considers these factors in light of the then-current size and composition of the Board. Although the Company does not have a formal diversity policy and does not follow any ratio or formula with respect to diversity in order to determine the appropriate composition of the Board, when considering a prospective nominee, the Board will generally take into account diversity of skills, experience and other qualities of the nominee that the Board believes can contribute to the success of the Company. No weight is assigned to any of the factors and the Board may change its emphasis on certain of these factors from time to time in light of the needs of the Company at the time. The Board will evaluate nominees of stockholders using the same criteria as it uses in evaluating other nominees to the Board.

A stockholder seeking to recommend a prospective nominee for consideration by the Board should submit the recommendation to the Board in the manner described under “Stockholder Communications with the Board of Directors” below, and in compliance with applicable SEC rules and regulations if the stockholder desires for the nominee to be included in the Company’s proxy statement for an annual meeting

7

of stockholders. Any stockholder recommendation must include, in addition to the name and business or residence address of the nominee, the written consent of the person being recommended to being named in the Company’s proxy statement relating to the stockholder vote on his or her election and to serving as a director if elected. Each stockholder recommendation must also include all information that would be required to be disclosed concerning such nominee in solicitations of proxies for the election of directors pursuant to Regulation 14A under the Exchange Act, including, but not limited to, the information required by Items 401, 403 and 404 of Regulation S-K of the SEC. In addition, the recommendation must include the recommending stockholder’s name, address and number of shares of the Company’s Common Stock owned by such stockholder as they appear on the Company’s stockholder records and the length of time the shares have been owned by the recommending stockholder (or, if held in “street name,” a written statement from the record holder of the shares confirming the information concerning such stock ownership of the recommending stockholder) and whether the recommendation is being made with or on behalf of one or more other stockholders (and, if so, similar information with respect to each other stockholder with or on behalf of whom the recommendation is being made).

Leadership Structure

The business of the Company is managed under the direction of the Company’s Board of Directors, which is elected by the Company’s stockholders. The fundamental responsibility of the Board is to lead the Company by exercising its business judgment to act in what each director believes to be the best interests of the Company and its stockholders.

The Company’s Board of Directors does not have any formal policy on whether the same person should serve as both the Chief Executive Officer and Chairman of the Board, as the Board believes that it should have the flexibility to make this determination at any given point in time in the way that it believes best to provide appropriate leadership for the Company at that time. The Board’s current leadership structure combines the position of Chairman and Chief Executive Officer. The Board believes that in the context of its current operating and business environment, the combined role of Chairman and Chief Executive Officer is appropriate because it results in unified leadership, accountability and continuity, promotes strategic development and execution, and facilitates communication between management and the Board. Henry M. Nahmad has held the dual position of Chairman and Chief Executive Officer since March 2015.

Risk Oversight

The Company’s Board of Directors is responsible for overseeing management and the business and affairs of the Company, which includes the oversight of risk. This oversight is conducted at the Board level as well as through the Audit Committee, which oversees the Company’s systems of internal control over financial reporting, accounting, legal compliance and risk management, and the Compensation Committee, which reviews compensation arrangements in an effort to, among other things, ensure that they do not encourage unnecessary or excessive risk taking. The Board as a whole has responsibility for overseeing management’s handling of the Company’s strategic and operational risks. As appropriate throughout the year, senior management reports to the Board the risks that it believes may be material to the Company, including those disclosed in the Company’s Annual Report on Form 10-K and other reports filed with the SEC. The goal of these processes is to achieve serious and thoughtful Board-level attention to the nature of the material risks faced by the Company and the adequacy of the Company’s risk management processes and systems. While the Board recognizes that the risks which the Company faces are not static and that it is not possible to identify or mitigate all risk and uncertainty all of the time, the Board believes that the Company’s approach to managing its risks provides the Board with the proper foundation and oversight perspective with respect to management of the material risks facing the Company.

8

Executive Sessions of Non-Management Directors

The independent directors of the Company’s Board of Directors meet at least annually, or more often as they determine to be necessary or advisable, in executive session without the presence of non-independent directors and management.

Stockholder Communications with the Board of Directors

Stockholders may communicate directly with the Company’s Board of Directors or one or more specific directors by sending a written communication to the Board or the director(s) to whom the communication is directed, c/o the Company’s President, 4500 Biscayne Blvd., Suite 340, Miami, Florida 33137. Except for communications that are (i) advertisements or promotional communications, (ii) related solely to complaints by users of the Company’s products or services that are ordinary course of business customer service and satisfaction issues or (iii) clearly unrelated to the Company’s business, industry or management, or Board or committee matters, the Company’s President will forward the communication to the Board or the director(s) to whom it is addressed, as the case may be, and, if the communication is not specifically addressed to any one director or group of directors, make the communication available to each member of the Board at the Board’s next regularly scheduled meeting. Each stockholder writing should include a statement indicating that he, she or it is a stockholder of the Company.

Code of Business Conduct and Ethics

The Company has adopted a Code of Business Conduct and Ethics that applies to all of its directors, officers and employees. The Code of Business Conduct and Ethics is supplemented by a Senior Financial Officer Code of Ethics that applies to the Company’s Chief Executive Officer and senior financial officers. The Code of Business Conduct and Ethics and the Senior Financial Officer Code of Ethics are posted in the “Investors – Corporate Governance – Governance Documents” section of the Company’s website at www.evi-ind.com. Any amendments to, or waivers of, the Code of Business Conduct and Ethics or Senior Financial Officer Code of Ethics (in each case, to the extent applicable to the Company’s principal executive officer, principal financial officer or principal accounting officer) will be posted on the Company’s website or made available by other appropriate means as required or permitted under applicable rules and regulations of the SEC and the NYSE American.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Exchange Act requires the Company’s directors, executive officers and 10% stockholders to file initial reports of ownership and reports of changes in ownership of the Company’s Common Stock and other equity securities, if any, with the SEC and the NYSE American. The Company’s directors, executive officers and 10% stockholders are required to furnish the Company with copies of all Section 16(a) reports they file. Based on a review of the copies of such reports furnished to the Company and written representations from the Company’s directors and executive officers that no other reports were required, the Company believes that its directors, executive officers and 10% stockholders complied with all Section 16(a) filing requirements applicable to them for fiscal 2019.

9

PROPOSAL NO. 1 - ELECTION OF DIRECTORS

The Company’s By-laws provide that the Board of Directors shall consist of no less than three or more than nine directors, and for each director to serve for a term expiring at the Company’s next annual meeting of stockholders. The specific number of directors is set from time to time by resolution of the Board. The Board of Directors currently consists of eight directors.

The Board has nominated six of its incumbent directors, Henry M. Nahmad, Dennis Mack, David Blyer, Alan M. Grunspan, Timothy P. LaMacchia and Hal M. Lucas, for re-election at the Annual Meeting. In addition, the Board has nominated Glen Kruger for election to the Board at the Annual Meeting. The Company has mutually agreed with each of Michael S. Steiner and Todd Oretsky, current directors of the Company, that Mr. Steiner and Mr. Oretsky will not be nominated or stand for re-election at the Annual Meeting and, accordingly, their service on the Board will cease upon the election of directors at the Annual Meeting. In connection with the foregoing, the Board has set the size of the Board at seven directors, effective as of the Annual Meeting.

Each of the director nominees is nominated to serve for a term expiring at the Company’s 2020 Annual Meeting of Stockholders and has consented to serve for his term. If any director nominee should become unavailable to serve as a director, the Board may designate a substitute nominee. In that case, the persons named as proxies will vote for the substitute nominee designated by the Board.

Nominees for Election as Directors

for Terms Expiring at the Company’s 2020 Annual Meeting of Stockholders

HENRY M. NAHMAD

Henry Nahmad, age 40, has served as a director of the Company and as Chairman, Chief Executive Officer and President of the Company since March 2015. Prior to joining the Company, Mr. Nahmad served as Chief Executive Officer of Chemstar Corp., a provider of food safety and sanitation solutions, from July 2009 to March 2014. From 2001 to 2004 and from 2007 to 2009, Mr. Nahmad worked in various capacities at Watsco, Inc., the largest distributor of HVAC/R products. The Board believes that Mr. Nahmad’s knowledge, leadership skills, business relationships, and experience, including with respect to growth from acquisitions and other strategic transactions, make Mr. Nahmad a valuable member of the Board and benefit the Company, including with respect to its business, operations and growth strategy.

DENNIS MACK

Dennis Mack, age 75, has served as a director of the Company since November 2016 and as Executive Vice President of the Company since October 2016 when he was appointed to such position in connection with the Company’s acquisition of substantially all of the assets of Western State Design LLC (“WSD”) at that time. In December 2018, his corporate title was changed to Executive Vice President, Corporate Strategy. Mr. Mack founded WSD in 1974 and served as its President. Since October 2016, he has served as the President of Western State Design, Inc. (“Western State Design”), the Company’s wholly owned subsidiary through which the Company acquired substantially all of the assets of WSD and conducts its business. The Board believes that it benefits from Mr. Mack’s knowledge of the commercial laundry industry as well as his understanding of the operations, prospects, products, customers, suppliers and employees of Western State Design.

DAVID BLYER

David Blyer, age 59, has served as a director of the Company since 1998. Since April 2017, Mr. Blyer has served as President and Chief Executive Officer of Arreva LLC (“Arreva”), which provides software to serve the fundraising and donor relationship management needs of nonprofit organizations.

10

Arreva is the successor by merger to DonorCommunity Inc. (“DonorCommunity”), a company founded by Mr. Blyer which provided a software platform to non-profit organizations to assist in their operational and fundraising activities. Mr. Blyer served as President and Chief Executive Officer of DonorCommunity from August 2010 until the time of its merger with Telosa Software to form Arreva. Mr. Blyer was Co-Chairman of Stone Profiles LLC (formerly Profiles in Concrete, Inc.), a manufacturer and installer of architectural cast stone for the residential and commercial construction markets, from January 2005 until March 2010. From July 2002 until January 2005, Mr. Blyer was an independent consultant. Mr. Blyer was Chief Executive Officer and President of Vento Software, Inc. (“Vento”), a developer of software for specialized business applications, from 1994, when he co-founded Vento, until November 1999, when Vento was acquired by SPSS Inc. (“SPSS”), a computer software company that developed and distributed technology for the analysis of data in decision-making and which merged with a subsidiary of International Business Machines Corporation in 2010. From November 1999 until December 2000, Mr. Blyer served as Vice President of Vento and, from January 2001 until July 2002, he served as President of the Enabling Technology Division of SPSS. The Board believes that Mr. Blyer brings to the Board broad experience in developing sales and marketing strategies, in addition to business operations skills gained through his founding and running of a number of diverse companies as well as his leading of a division of SPSS, which at the time was a publicly-held company. Mr. Blyer has an MBA in finance.

ALAN M. GRUNSPAN

Alan M. Grunspan, age 59, has served as a director of the Company since 1999. Since December 2004, Mr. Grunspan has been a Shareholder of the law firm of Carlton Fields Jorden Burt, P.A. (“Carlton Fields”). From 1989 until he joined Carlton Fields, Mr. Grunspan was a member of the law firm of Kaufman Dickstein & Grunspan, P.A. The Board believes that it benefits from Mr. Grunspan’s service due to, among other things, his over 25 years of experience as a business lawyer with an understanding of the industry in which the Company operates and environmental matters, including those that particularly pertain to the dry cleaning and laundry industry. The Board also believes that Mr. Grunspan brings valuable financing expertise to the Board obtained from his Bachelor of Sciences degree in finance and his legal practice, and that he provides management experience to the Board obtained from his management of a law firm prior to joining Carlton Fields.

TIMOTHY P. LaMACCHIA

Timothy P. LaMacchia, age 57, has served as a director of the Company since December 2017. Mr. LaMacchia is a private investor. He was a Partner at Ernst & Young LLP from 2002 until his retirement in June 2017. Prior to joining Ernst & Young LLP, Mr. LaMacchia was a Partner at Arthur Andersen LLP, where he was employed since 1986. The Board believes that Mr. LaMacchia provides meaningful insight to the Board and makes important contributions to the Audit Committee, including as a result of his finance and accounting background.

HAL M. LUCAS

Hal M. Lucas, age 40, has served as a director of the Company since 2015. Mr. Lucas is an attorney in private practice. He is a founding partner of the law firm of Lucas Savitz P.L. (and its predecessor), where Mr. Lucas has practiced since 2011. Prior to that time, Mr. Lucas was an attorney at the law firm of Astigarraga Davis Mullins & Grossman, P.A. from 2008 to 2011 and at the law firm of Bilzin Sumberg Baena Price & Axelrod LLP from 2004 to 2008. Mr. Lucas also served as Of Counsel to Astigarraga Davis Mullins & Grossman, P.A. from 2011 to 2013. Mr. Lucas obtained his Juris Doctor degree from The University of Texas School of Law and a Bachelor’s degree in economics and international relations from The Johns Hopkins University. The Board believes that it benefits from Mr. Lucas’ experience in legal and business matters gained from his career as a practicing attorney, and that Mr. Lucas’ experience relating to his co-founding and co-management of Lucas Savitz P.L. is a valuable asset to the Board.

11

Glen Kruger

Glen Kruger, age 44, has been nominated for election as a director of the Company at the Annual Meeting. Since February 2017, Mr. Kruger has served a Director, Investment Banking at GCA Advisors, LLC, a global investment bank that provides strategic merger and acquisition, capital markets and private funds advisory services to growth companies and market leaders. From February 2012 until he joined GCA Advisors in February 2017, Mr. Kruger was a Director, Investment Banking at KeyBanc Capital Markets. He received a BSc in Mechanical Engineering from the University of Natal (South Africa) and an MBA from Babson College. The Board believes that Mr. Kruger will be a valuable contributor to the Board based on, among other things, his experience and expertise with respect to the capital markets and merger and acquisition transactions.

The Board of Directors Recommends that Stockholders

Vote “For” the Election of All Seven Director Nominees.

12

IDENTIFICATION OF EXECUTIVE OFFICERS

The following individuals are executive officers of the Company as of the date of this Proxy Statement:

| Name | Position |

| Henry M. Nahmad | Chairman, Chief Executive Officer and President |

| Dennis Mack | Executive Vice President, Corporate Strategy |

| Tom Marks | Executive Vice President, Business Development |

| Michael S. Steiner | Executive Vice President |

| Robert H. Lazar | Chief Financial Officer, Chief Accounting Officer and Treasurer |

All executive officers serve until they resign or are replaced or removed by the Board of Directors. Set forth below is certain biographical information for Messrs. Steiner, Marks and Lazar. Biographical information for Messrs. Nahmad and Mack is set forth in “Proposal No. 1 – Election of Directors” above.

Tom Marks, age 60, has served as Executive Vice President of the Company since October 2016 when he was appointed to such position in connection with the Company’s acquisition of substantially all of the assets of WSD at that time. In December 2018, his corporate title was changed to Executive Vice President, Business Development. Mr. Marks is also Executive Vice President of Western State Design. He was employed by WSD since 1987, including as Executive Vice President since 2007.

Michael S. Steiner, age 63, has served Executive Vice President of the Company since March 2015 and as a director of the Company since 1998. He served as the Company’s Chairman from December 2012 through March 2015 and the Company’s Chief Operating Officer from March 2015 through December 2018. He also served as Chief Executive Officer and President of the Company from November 1998, when the Company acquired Steiner-Atlantic Corp. (“Steiner-Atlantic”), a wholly owned subsidiary of the Company, through March 2015. Mr. Steiner has been President and Chief Executive Officer of Steiner-Atlantic since 1988. As previously described, the Company and Mr. Steiner have mutually agreed that Mr. Steiner will not be nominated or stand for re-election as a director at the Annual Meeting and, accordingly, his service as a director of the Company will cease upon the election of directors at the Annual Meeting. In addition, it is not expected that Mr. Steiner will be re-appointed as an executive officer of the Company upon the Board’s annual appointment of the Company’s executive officers on the date of the Annual Meeting.

Robert H. Lazar, age 55, was appointed to serve as the Company’s Chief Financial Officer in May 2017 after joining the Company as its Chief Accounting Officer and Vice President of Finance in January 2017. Mr. Lazar previously served as Chief Accounting Officer and Vice President of Finance for Steiner Leisure Limited, a provider of spa services and manufacturer and distributor of cosmetics, where he was employed since 2000. Prior to joining Steiner Leisure Limited, Mr. Lazar worked in various capacities at Arthur Andersen LLP, including as Senior Manager from 1995 to 2000.

13

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

Controlling Stockholder; Stockholders Agreements

As the Manager of Symmetric Capital and Symmetric Capital II, Henry M. Nahmad, the Company’s Chairman, Chief Executive Officer and President, may be deemed to have beneficial ownership of all of the shares of the Company’s Common Stock beneficially owned directly or indirectly by Symmetric Capital and Symmetric Capital II. Symmetric Capital and Symmetric Capital II directly own 2,838,194 shares and 1,290,323 shares, respectively, of the Company’s Common Stock, which represent approximately 22.4% and 10.2%, respectively, of the total number of issued and outstanding shares of the Company’s Common Stock. In addition, as a result of the Stockholders Agreements described below, Symmetric Capital and Mr. Nahmad, as its Manager, have voting power over (i) all 580,100 shares of the Company’s Common Stock owned by Michael S. Steiner and his brother, Robert M. Steiner, and (ii) all 2,044,990 shares of the Company’s Common Stock owned by WSD, Dennis Mack and Tom Marks. As a result, including shares subject to restricted stock awards granted to Mr. Nahmad which have not yet vested but as to which he has the power to vote, Mr. Nahmad may be deemed to have voting power over a total of 7,495,239 shares of the Company’s Common Stock as of November 14, 2019, which represents approximately 59.3% of the issued and outstanding shares of the Company’s Common Stock as of such date. Accordingly, Mr. Nahmad has the voting power to control the election of the Company’s directors and any other matter requiring the affirmative vote or consent of a majority of the outstanding shares of the Company’s Common Stock.

Pursuant to a Stockholders Agreement dated March 6, 2015 between Mr. Nahmad, Symmetric Capital, Mr. Michael Steiner and Mr. Robert Steiner (the “Symmetric Capital - Steiner Stockholders Agreement”), each of Mr. Michael Steiner and Mr. Robert Steiner agreed to vote all shares of the Company’s Common Stock owned by them at any time during the term of the Symmetric Capital - Steiner Stockholders Agreement as directed by Mr. Nahmad, as the Manager of Symmetric Capital, and have granted to Mr. Nahmad, as the Manager of Symmetric Capital, an irrevocable proxy and power of attorney in furtherance thereof. The Symmetric Capital - Steiner Stockholders Agreement has a term of five years, subject to earlier termination under certain circumstances.

In addition, pursuant to a Stockholders Agreement dated October 10, 2016 between the Company, Mr. Nahmad, Symmetric Capital, Symmetric Capital II, WSD, Mr. Mack and Mr. Marks (the “Symmetric Capital – WSD Stockholders Agreement”), WSD, Mr. Mack and Mr. Marks have agreed to vote all of the shares of the Company’s Common Stock owned by them at any time during the term of the Symmetric Capital – WSD Stockholders Agreement as directed by Mr. Nahmad, as the Manager of Symmetric Capital, and have granted to Mr. Nahmad, as the Manager of Symmetric Capital, an irrevocable proxy and power of attorney in furtherance thereof. The Symmetric Capital – WSD Stockholders Agreement also contains, among other things, an agreement by Mr. Nahmad, Symmetric Capital and Symmetric Capital II to, until October 10, 2021 (subject to earlier termination of such obligation under certain circumstances), vote all of the shares of the Company’s Common Stock owned by them in favor of the election of Mr. Mack to the Company’s Board of Directors. In addition, under certain circumstances (none of which have occurred to date), during the term of the obligation described in the preceding sentence, Mr. Nahmad, Symmetric Capital and Symmetric Capital II will be required to vote to elect Mr. Marks (in lieu of Mr. Mack) to the Company’s Board of Directors. The Symmetric Capital – WSD Stockholders Agreement has a term of five years, subject to earlier termination under certain circumstances.

Related Person Transactions

The Company’s wholly-owned subsidiary, Steiner-Atlantic, leases 28,000 square feet of warehouse and office space from an affiliate of Michael S. Steiner, a current director and Executive Vice President of the Company, pursuant to a lease agreement dated November 1, 2014, as amended. The lease term was extended during December 2018 to run through December 31, 2019. Monthly base rental payments under the lease are $12,000. In addition to base rent, Steiner-Atlantic is responsible under the lease for costs related to real estate

14

taxes, utilities, maintenance, repairs and insurance. Payments under this lease totaled approximately $146,000 and $137,000 during the fiscal years ended June 30, 2019 and 2018, respectively.

On October 10, 2016, the Company’s wholly-owned subsidiary, Western State Design, entered into a lease agreement pursuant to which it leases 17,600 square feet of warehouse and office space from an affiliate of Dennis Mack, a director and Executive Vice President, Corporate Strategy of the Company, and Tom Marks, Executive Vice President, Business Development of the Company. Monthly base rental payments are $12,000 during the initial term of the lease. In addition to base rent, Western State Design is responsible under the lease for costs related to real estate taxes, utilities, maintenance, repairs and insurance. The lease has an initial term of five years and provides for two successive three-year renewal terms at the option of the Company. Payments under this lease totaled approximately $144,000 during each of the fiscal years ended June 30, 2019 and 2018.

On October 31, 2017, the Company’s wholly-owned subsidiary, Tri-State Technical Services, Inc. (“Tri-State”), entered into lease agreements pursuant to which it leases a total of 81,000 square feet of warehouse and office space from an affiliate of Matt Stephenson, President of Tri-State. Monthly base rental payments total $21,000 during the initial terms of the leases. In addition to base rent, Tri-State is responsible under the leases for costs related to real estate taxes, utilities, maintenance, repairs and insurance. Each lease has an initial term of five years and provides for two successive three-year renewal terms at the option of the Company. Payments under these leases totaled approximately $252,000 during the fiscal year ended June 30, 2019 and $168,000 during the period from October 31, 2017 through June 30, 2018.

On February 9, 2018, the Company’s wholly-owned subsidiary, AAdvantage Laundry Systems, Inc. (“AAdvantage”), entered into a lease agreement pursuant to which it leases a total of 5,000 square feet of warehouse and office space from an affiliate of Mike Zuffinetti, Chief Executive Officer of AAdvantage. Monthly base rental payments are $3,950 during the initial term of the lease. In addition to base rent, AAdvantage is responsible under the lease for costs related to real estate taxes, utilities, maintenance, repairs and insurance. The lease has an initial term of five years and provides for two successive three-year renewal terms at the option of the Company. During February 2018, AAdvantage entered into a month-to-month lease agreement with an affiliate of Mike Zuffinetti for a total of 17,000 square feet of warehouse and office space. Monthly base rental payments under this lease were $13,500. This month-to-month lease was terminated on October 31, 2018. In addition, on November 1, 2018, AAdvantage entered into a lease agreement pursuant to which it leases warehouse and office space from an affiliate of Mr. Zuffinetti. Monthly base rental payments were initially $26,000. Pursuant to the lease agreement, on January 1, 2019, the lease expanded to cover additional warehouse space and, in connection therewith, monthly base rental payments increased to $36,000. In addition to base rent, AAdvantage is responsible under the lease for costs related to real estate taxes, utilities, maintenance, repairs and insurance. The lease has an initial term of five years and provides for two successive three-year renewal terms at the option of the Company. Payments under the leases described in this paragraph totaled approximately $369,000 during the fiscal year ended June 30, 2019. Payments under the leases from February 9, 2018 through June 30, 2018 were approximately $87,000.

On September 12, 2018, the Company’s wholly-owned subsidiary, Scott Equipment, Inc. (“Scott Equipment”), entered into lease agreements pursuant to which it leases a total of 18,000 square feet of warehouse and office space from an affiliate of Scott Martin, President of Scott Equipment. Monthly base rental payments total $11,000 during the initial terms of the leases. In addition to base rent, Scott Equipment is responsible under the leases for costs related to real estate taxes, utilities, maintenance, repairs and insurance. Each lease has an initial term of five years and provides for two successive three-year renewal terms at the option of the Company. Payments under these leases totaled approximately $114,000 during the fiscal year ended June 30, 2019.

On February 5, 2019, the Company’s wholly-owned subsidiary, PAC Industries Inc. (“PAC Industries”), entered into two lease agreements pursuant to which it leases a total of 29,500 square feet of warehouse and office space from an affiliate of Frank Costabile, President of PAC Industries, and Rocco

15

Costabile, Director of Finance of PAC Industries. Monthly base rental payments total $14,600 during the initial terms of the leases. In addition to base rent, PAC Industries is responsible under the leases for costs related to real estate taxes, utilities, maintenance, repairs and insurance. Each lease has an initial term of four years and provides for two successive three-year renewal terms at the option of the Company. Payments under these leases totaled approximately $73,000 during the fiscal year ended June 30, 2019.

16

NAMED EXECUTIVE OFFICER COMPENSATION

Summary Compensation Table

The following table sets forth certain summary information concerning compensation which, for the fiscal years ended June 30, 2019 and 2018, the Company paid to, or accrued on behalf of, Henry M. Nahmad, the Company’s Chairman, Chief Executive Officer and President, and the Company’s next two highest paid executive officers during the fiscal year ended June 30, 2019 (collectively, the “Named Executive Officers”).

| Name and Principal Positions(1) |

Fiscal Year |

Salary(2) | Bonus(3) | Stock Awards |

Option Awards |

Non-Equity Plan |

Change in Pension Value and Nonqualified Deferred Compensation Earnings |

All Other |

Total |

|

Henry M. Nahmad Chairman, Chief Executive |

2019

2018

|

$550,000

$550,000 |

-

$400,000 |

-

- |

-

- |

-

- |

-

- |

-

- |

$550,000

$950,000 |

|

Dennis Mack Executive Vice President, |

2019

2018

|

$300,000

$300,000 |

$150,000

$100,000 |

-

- |

-

- |

-

- |

-

- |

$ 8,250

- |

$458,250

$400,000 |

|

Tom Marks Executive Vice President, |

2019

2018

|

$300,000

$300,000 |

$150,000

$100,000 |

-

- |

-

- |

-

- |

-

- |

$ 8,250

- |

$458,250

$400,000 |

| (1) | The Company does not have an employment agreement with any of the Named Executive Officers. The compensation of the Named Executive Officers is determined by the Compensation Committee of the Board of Directors. Each Named Executive Officer receives an annual base salary and may receive bonuses, in cash and/or equity awards, pursuant to bonus plans which may established from time to time by the Compensation Committee or otherwise at the discretion of the Compensation Committee. Equity awards, if any, are granted under the Company’s 2015 Equity Incentive Plan (the “Equity Incentive Plan”). The Named Executive Officers are also provided certain benefits, including health and welfare benefits and the right to participate in the Company’s participatory Section 401(k) Profit Sharing Plan described below, on the same basis as the Company’s other employees. |

| (2) | Represents the annual base salary paid to the Named Executive Officer during the applicable fiscal year. Each Named Executive Officer's annual base salary is subject to adjustment from time to time at the discretion of the Compensation Committee. |

| (3) | Represents discretionary cash bonuses paid upon the approval of the Compensation Committee, in each cash, based upon a subjective evaluation of the performance of the Company and the applicable Named Executive Officer. With respect to the bonuses paid to Mr. Mack and Mr. Marks for fiscal years 2019 and 2018, the Compensation Committee considered the recommendation of the Company’s Chief Executive Officer and the positive performance of the Company and its operating subsidiaries, including Western State Design (of which Mr. Mack is the President and Mr. Marks is Executive Vice President), and the Company’s financial condition. With respect to the bonus paid to Mr. Nahmad for fiscal 2018, the Compensation Committee considered the success of the Company’s growth strategy and achievements with respect to strategic acquisitions, as well as Mr. Nahmad’s role with respect thereto, and the Company’s financial results and condition, including its cash position. In approving the bonus to Mr. Nahmad, the Compensation Committee also considered the report and recommendation of, and the | |

17

| Compensation Committee’s discussions with, Pearl Meyer & Partners, LLC, a third party compensation consultant, regarding such bonus. |

Outstanding Equity Awards at June 30, 2019

The following table sets forth certain information regarding restricted stock awards of the Company’s Common Stock held by Henry M. Nahmad. Other than as set forth below, none of the Named Executive Officers held any restricted stock awards or other equity-based awards, including stock options, of the Company at June 30, 2019.

| Stock Awards | ||||

| Name |

Number of shares or units of stock that have not vested (#) |

Market value of ($) |

Equity incentive plan awards: unearned shares, units or (#) |

Equity incentive plan awards: unearned shares, units or ($) |

| Henry M. Nahmad | 362,917(1) | $13,888,834 | - | - |

| 362,917(2) | $13,888,834 | - | - | |

| (1) | Subject to the terms and conditions of the Company’s Equity Incentive Plan and the related award agreement, including as described below under “Compensation Plans and Arrangements,” 75% of these restricted shares are scheduled to vest on November 5, 2040, the date on which Mr. Nahmad will reach the age of 62, and the balance of these restricted shares is scheduled to vest in two remaining equal annual installments in November 2019 and 2020. |

| (2) | Subject to the terms and conditions of the Company’s Equity Incentive Plan and the related award agreement, including as described below under “Compensation Plans and Arrangements,” 75% of these restricted shares are scheduled to vest on November 5, 2040, the date on which Mr. Nahmad will reach the age of 62, and the balance of these restricted shares is scheduled to vest in two remaining equal annual installments in June 2020 and 2021. |

Compensation Plans and Arrangements

As described above, no Named Executive Officer is a party to an employment agreement with the Company. In addition, the Company has no plans or arrangements with any Named Executive Officer which provide for the payment of retirement benefits, or benefits that would be paid primarily following retirement, other than the Company’s participatory Section 401(k) Profit Sharing Plan, a deferred compensation plan under which the Company matches 50% of employee contributions up to 6% of an eligible employee’s yearly compensation on a discretionary basis. Such compensation is tax deferred under Section 401(k) of the Internal Revenue Code of 1986, as amended (the “Code”). Further, the Company has no contracts, agreements, plans or arrangements that provide for the payment in the future to any Named Executive Officer following or in connection with his resignation, termination of employment or a change in control of the Company. However, outstanding restricted stock awards of the Company’s Common Stock, including those granted to Mr. Nahmad, will accelerate and immediately vest, to the extent not previously vested or forfeited, in the event of the award holder’s death or Disability (as defined in the award agreements). In addition, pursuant to the Company’s Equity Incentive Plan, such restricted stock awards may, in the discretion of the

18

Compensation Committee, accelerate and immediately vest, to the extent not previously vested or forfeited, upon a Change in Control of the Company (as defined in the Company’s Equity Incentive Plan). In the event that vesting is accelerated, any unrecognized stock-based compensation expense would be immediately recognized. Had the restricted stock awards held by Mr. Nahmad vested upon his death or Disability or upon a Change in Control of the Company as of June 30, 2019, the value of the accelerated vesting of the restricted shares would have been $27,777,667 (based on the closing price of the Company’s Common Stock on the NYSE American on June 30, 2019 and the number of restricted shares of Common Stock that would have been subject to accelerated vesting) and the Company would have recognized $11,038,027 of stock-based compensation.

19

PROPOSAL NO. 2 - NON-BINDING ADVISORY VOTE ON

NAMED EXECUTIVE OFFICER COMPENSATION (SAY ON PAY)

Pursuant to Section 14A of the Exchange Act and the rules and regulations promulgated thereunder, the Company’s stockholders will be asked at the Annual Meeting to vote, on a non-binding advisory basis, on the compensation of the Company’s Named Executive Officers (sometimes hereinafter referred to as the “Say on Pay Proposal”).

The vote on the Say on Pay Proposal gives the Company’s stockholders the opportunity to express their views on the compensation paid to the Named Executive Officers. The vote is not intended to address any specific item of compensation, but rather the overall compensation of the Named Executive Officers as disclosed in this Proxy Statement. You are urged to read the “Named Executive Officer Compensation” section of this Proxy Statement above for details regarding the compensation paid to the Named Executive Officers during fiscal 2019 and other information with respect to their compensation for services on behalf of the Company.

The Board believes that the Company’s compensation program for its executive officers, including the Named Executive Officers, is appropriately based upon the Company’s performance, the performance and level of responsibility of the executive officer and the market generally with respect to executive officer compensation. The Board also believes that the Company’s executive compensation program aligns the interests of the Company’s executive officers with those of the Company’s stockholders by compensating the executive officers in a manner designed to advance both the short-and long-term interests of the Company and its stockholders. As a result, the Board recommends that the Company’s stockholders indicate their support for the compensation of the Named Executive Officers by approving the following resolution:

“RESOLVED, that the compensation paid to the Company’s Named Executive Officers for the fiscal year ended June 30, 2019, as disclosed pursuant to SEC rules, including the compensation tables and related narrative disclosures included in this Proxy Statement, is hereby APPROVED.”

Stockholders may vote for or against, or abstain from voting on, the Say on Pay Proposal. The compensation of the Named Executive Officers in connection with the Say on Pay Proposal will be approved, on a non-binding advisory basis, if it receives the affirmative vote of a majority of the shares of the Company’s Common Stock present in person or represented by proxy at the Annual Meeting and entitled to vote on the proposal. Abstentions will effectively count as votes against the Say on Pay Proposal. Failures to vote will not have any impact on the Say on Pay Proposal.

The vote on the Say on Pay Proposal is advisory only and will not be binding upon the Company or its Board of Directors or Compensation Committee. However, the Board of Directors and Compensation Committee appreciate the opinions that the Company’s stockholders express in their votes and will consider the outcome of the vote in connection with future executive compensation arrangements.

The Board of Directors Recommends that Stockholders

Vote “For” the Say on Pay Proposal.

20

PROPOSAL NO. 3 - NON-BINDING ADVISORY VOTE ON

THE FREQUENCY OF THE SAY ON PAY VOTE (SAY ON FREQUENCY)

Pursuant to Section 14A of the Exchange Act and the rules and regulations promulgated thereunder, the Company’s stockholders will also be asked at the Annual Meeting to vote, on a non-binding advisory basis, on whether the stockholders’ advisory vote on the Say on Pay Proposal should be held every year, every other year or every three years (sometimes hereinafter referred to as the “Say on Frequency Proposal”).

Under applicable SEC rules, the Say on Frequency Proposal is required to be presented for a non-binding advisory stockholder vote every six years. At the Company’s 2013 Annual Meeting of Stockholders, the Company’s stockholders voted, on a non-binding advisory basis, for the Say on Pay Proposal to be presented for a non-binding advisory stockholder vote every three years. Since that time, the Company has presented the Say on Pay Proposal for a non-binding advisory stockholders vote every three years.

After consideration of the frequency alternatives, the Board believes that the Say on Pay Proposal should continue to be presented to a vote of the Company’s stockholders every three years. As described above, the Board believes that the Company’s executive compensation program is designed to provide compensation that is commensurate and aligned with the performance of the Company and the executives, and advances both the short-and long-term interests of the Company and its stockholders. In addition, the Board believes a three-year period allows the Company’s stockholders time to better judge the Company’s executive compensation program in relation to performance over time. The Board further believes that giving the Company’s stockholders the right to cast an advisory vote on the Say on Pay Proposal every three years provides the Board with sufficient time to thoughtfully consider stockholder input, including voting results, and to effectively implement any changes to the Company’s executive compensation program it deems appropriate.

Stockholders will not be voting to specifically approve or disapprove the Board’s recommendation that the Say on Pay Proposal be presented for a non-binding advisory vote of the Company’s stockholders every three years. Rather, stockholders may vote for the Say on Pay Proposal to be presented for a non-binding advisory vote of the Company’s stockholders every year, every other year, or every three years. The frequency that receives the highest number of votes cast by stockholders will be the frequency that has been selected by the stockholders. Abstentions and failures to vote will not have any impact on the proposal.

The vote on the Say on Frequency Proposal is advisory only and will not be binding upon the Company or its Board of Directors or Compensation Committee, and the Board of Directors, upon the recommendation of the Compensation Committee or otherwise, may decide that it is in the best interests of the Company and its stockholders to hold future advisory votes on the Say on Pay Proposal more or less frequently than the option selected by the stockholders. However, the Board of Directors and the Compensation Committee appreciate the opinions that the Company’s stockholders express in their votes and will consider the outcome of the vote when establishing the frequency of future advisory votes on the Say on Pay Proposal.

The Board of Directors Recommends that Stockholders Vote for the

Non-Binding Advisory Vote on the Say on Pay Proposal to be Held “Every Three Years.”

21

DIRECTOR COMPENSATION

The Compensation Committee, with the input and assistance of the Company’s Chief Executive Officer, recommends director compensation to the full Board of Directors. The Board of Directors approves director compensation based on factors it considers to be appropriate, market conditions and trends, and the recommendation of the Compensation Committee.

The compensation program for the Company’s non-employee directors is intended to assist the Company in attracting and retaining qualified directors, reward non-employee directors for their service on the Board and its committees through both equity awards and cash fees, and align the interests of the non-employee directors with those of stockholders. Pursuant to the program, each non-employee director receives annually a grant of $50,000 of restricted stock awards (based on the closing price of the Company’s Common Stock on the date of grant), which generally vest in four equal annual installments beginning on the first anniversary of the grant date. The restricted stock awards are granted under, and subject to, the Company’s Equity Incentive Plan and related award agreements. In addition to restricted stock awards, the Company’s compensation program for its non-employee directors also includes a cash component, pursuant to which (i) each non-employee director currently receives an annual cash fee of $5,000, (ii) the Chairman of the Audit Committee currently receives an additional annual cash fee of $10,000, (iii) each other member of the Audit Committee currently receives an additional annual cash fee of $2,500, (iv) the Chairman of the Compensation Committee currently receives an additional annual cash fee of $5,000, and (v) each other member of the Compensation Committee currently receives an additional annual cash fee of $3,500 (which was increased from $1,500 during December 2018).

The Company does not provide any tax gross-ups to its non-employee directors, all of whom are responsible for their respective tax obligations relating to their compensation for Board and committee service. Directors are also reimbursed for their reasonable out-of-pocket expenses incurred in connection with performing their duties. Directors of the Company who are also employees of the Company do not receive compensation for their service as directors, but are reimbursed for their reasonable out-of-pocket expenses incurred in connection with performing their duties as directors.

Director Compensation Table – Fiscal 2019

The following table sets forth certain information regarding the compensation paid to each individual who served as a non-employee director of the Company during fiscal 2019 in consideration for his service on the Board and its committees during the year.

Name |

Fees Earned or Paid in Cash |

Stock Awards(1) |

Option Awards |

Non-Equity Incentive Plan Compensation |

Change in Pension Value and Nonqualified Deferred Compensation Earnings |

All Other Compensation |

Total | |

| David Blyer | $7,500 | $50,000 | - | - | - | - | $57,500 | |

| Alan M. Grunspan | $7,500 | $50,000 | - | - | - | - | $57,500 | |

| Timothy P. LaMacchia | $15,000 | $50,000 | - | - | - | - | $65,000 | |

| Hal M. Lucas | $10,000 | $50,000 | - | - | - | - | $60,000 | |

| Todd Oretsky | $7,500 | $50,000 | - | - | - | - | $57,500 | |

| (1) | Represents the grant date fair value of the restricted stock awards granted to each non-employee director during December 2018. The restricted stock awards granted to each non-employee director cover a total of 1,369 shares and are scheduled to vest in equal annual installments on the first, second, third and fourth anniversary of the grant date. Assumptions used in the calculation of the grant date fair value of these restricted stock awards are included in Note 19 to Company’s audited consolidated financial statements included in the Company’s Annual Report on Form 10-K for the fiscal year ended June 30, 2019, as filed with the SEC on September 13, 2019. |

22

AUDIT COMMITTEE REPORT

The following Audit Committee Report shall not be deemed to be “soliciting material” or to be “filed” with the SEC or subject to Regulation 14A or 14C promulgated by the SEC, other than as provided in Item 407 of Regulation S-K promulgated by the SEC, or to the liabilities of Section 18 of the Exchange Act, except to the extent that the Company specifically requests that the following Audit Committee Report be treated as “soliciting material” or specifically incorporates it by reference into a document filed under the Securities Act or the Exchange Act..

The Audit Committee of the Company’s Board of Directors reviewed and discussed the Company’s audited consolidated financial statements for the fiscal year ended June 30, 2019 with management and BDO USA, LLP (“BDO”), the Company’s independent registered public accounting firm.

Management has primary responsibility for the Company’s financial statements and the overall financial reporting process, including the Company’s system of internal controls. The Company’s independent registered public accounting firm audits the annual financial statements prepared by management, expresses an opinion as to whether those financial statements present fairly, in all material respects, the financial position, results of operations and cash flows of the Company in conformity with accounting principles generally accepted in the United States of America, and discusses with the Audit Committee its independence and any other matters that it is required to discuss with the Audit Committee or that it believes should be raised with it. The Audit Committee oversees these processes, although it must rely on information provided to it and on the representations made by management and the Company’s independent registered public accounting firm.

The Audit Committee met with BDO, with and without management present, to discuss the results of BDO’s examinations, BDO’s evaluations of the Company’s internal controls and the overall quality of the Company’s financial reporting. The Audit Committee also discussed with BDO the matters required to be discussed with audit committees under generally accepted auditing standards, including, among other things, matters required to be discussed by the statement on Auditing Standards No. 61, as amended (AICPA, Professional Standards, Vol. 1. AU section 380), as adopted by the Public Company Accounting Oversight Board in Rule 3200T.